S&P says insurer ratings resilient for now but potential pressure coming from erosion of capital buffers S&P’s latest commentary on global insurance ratings continues the focus on COVID-19 as the current primary driver of ratings. The headline message remains that most insurer ratings are still ‘resilient’ given the extent of capital buffers. However, erosion of these is expected during the second half of 2020, as

Read more →A.M. Best moves to COVID-19 phase 2 Stuart ShipperleeHead of Analytics Rowena PotterSenior Consultant Analyst Earlier this week A.M. Best (“Best”) announced the results of its initial response to COVID-19, reviewing a set of capital adequacy “stress-tests” across its rated universe using its capital model (the “BCAR”).

Read more →Ratings activity from the major agencies has differed very substantially in the first months of the pandemic’s global impact Stuart ShipperleeHead of Analytics Rowena PotterSenior Consultant Analyst Despite highly similar headline views on the main drivers of the credit rating impact of COVID-19 on (re)insurers, in practice rating

Read more →An examination of the P&C treaty renewals of the big four European reinsurance groups Lewis PhillipsConsultant Analyst Lucy StupplesConsultant Analyst The big four European reinsurance groups reported divergent results from the 1 January 2020 renewals. The change in renewed premiums varied from +14% for Hannover Re to

Read more →Key changes to S&P’s Insurers Rating Methodology: A primer and Litmus guidance. S&P recently completed a “Request for Comment” (”RfC”) period for proposed changes to its Insurance Ratings Methodology*. It is now reviewing the comments and finalising the criteria and the related guidance. While these may therefore

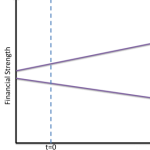

Read more →First thoughts on how brokers should consider the financial health of insurers In certain jurisdictions we have seen an increasing regulatory and market focus on the financial health of insurers, increasing the risk that brokers the blame for using an insurer that fails. In this discussion document,

Read more →Why rising interest rates won’t, on their own, improve non-life reinsurers’ operational earnings. Non-life reinsurance pricing has been deemed inadequate by many market practitioners since 2014. While this has hit profitability, it is often seen as only part of the difficult environment for reinsurer earnings, the other

Read more →Inflating the way to reserve deficiencies The dog that hasn’t barked Many market participants and analysts have been waiting for some time for casualty reserve releases to dry up and deficiencies to emerge. Yet, while there have been a few high-profile cases of the latter, so far

Read more →When is a BBB rating really the same as an A+? For most traditional reinsurers a credit rating from one of the main agencies remains a business requirement. And in developed markets that rating often needs to be “A-“ or higher, at least if the reinsurer is

Read more →Why reinsurance practitioners should understand the drivers of cedant ratings Even in those markets where ratings are fundamental to carrier selection, most practitioners tend not to dwell too much on the details of how ratings are decided. Yet, for reinsurers and reinsurance brokers with rated cedant clients,

Read more →